Who we are

Convergence is the global expert in trade finance solutions. We are a service provider and advisory firm that has developed a Supply Chain Finance system, Abacus, that has been implemented with multiple banks and non-bank institutional lenders globally. We deliver trade finance services to funders and corporates across 6 continents with a primary focus in Asia Pacific.

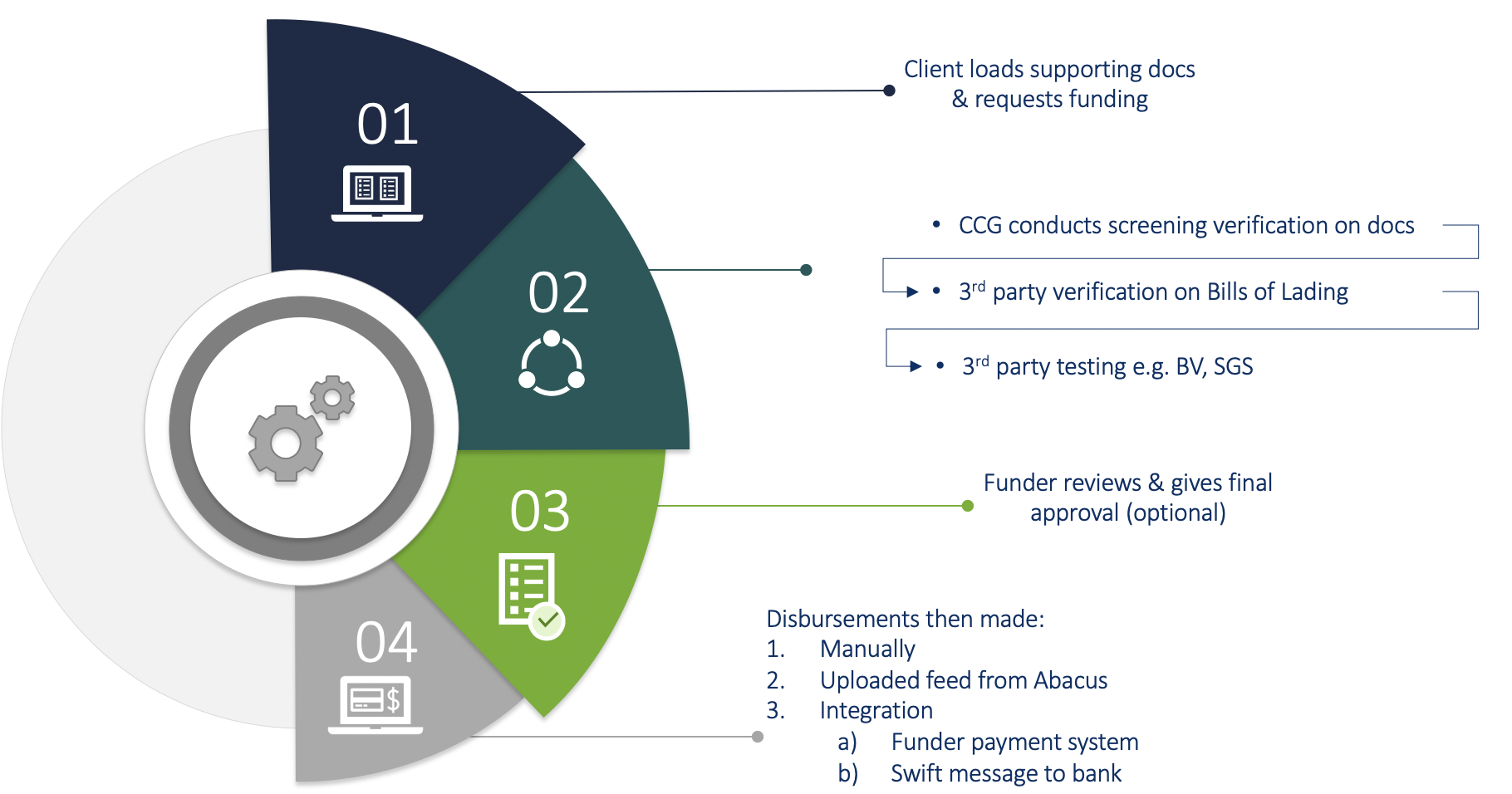

Our advisory services for funders and corporates normally leads to follow-on support through our technology platform, Abacus, along with outsourcing of key functions such as client due diligence, transactional validity checks and remittance operations. Our effective reporting allows funders to maintain strict controls on potential fraud and also helps them tightly manage portfolio aspirations and investment mandates.

What is Trade Finance?

- Trade finance represents monetary activities related to commerce and international trade. Trade finance includes lending, the issuance of letters of credit, factoring, export credit and insurance. Companies involved with trade finance include importers and exporters, banks and financiers, insurers and export credit agencies, and service providers.

- The function of trade finance is to introduce a third-party to transactions to remove the payment risk and the supply risk while providing the exporter with receivables according to the agreement and the importer with extended credit. Suppliers, banks, syndicates, trade finance houses and buyers all provide trade financing. Convergence helps bring all of these pieces together through our technology and support services, ensuring effective funding and settlement of loans over the life of the financing agreement.

What we do

We facilitate supply chain finance and structured trade programs to support corporates across the globe. Convergence also works with funders during each step of the process to help them bring efficiency to their own internal operations. We subdivide our service offering into 3 key areas.

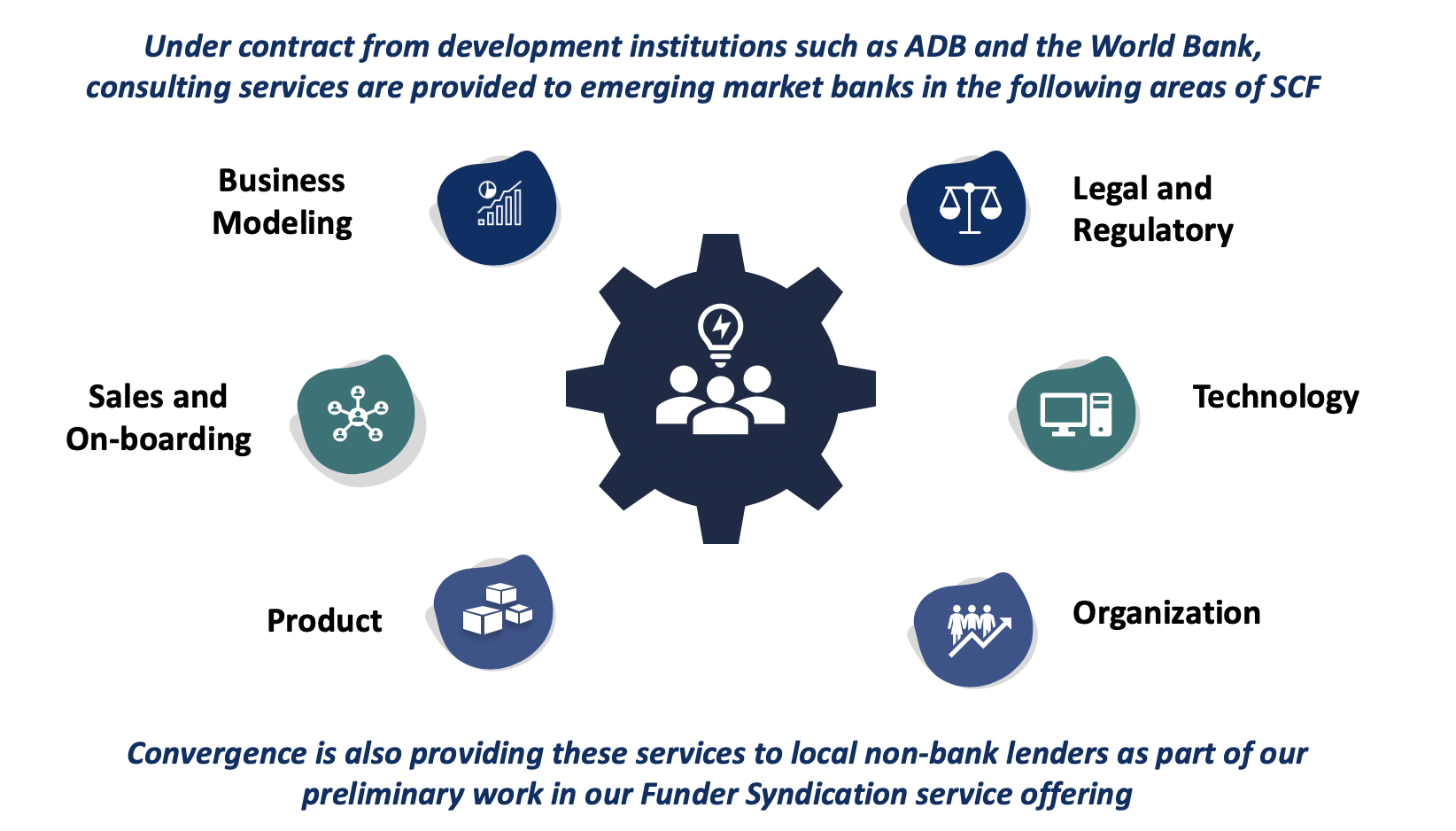

Funder Advisory

Convergence works with banking partners and alternative lenders to design jurisdictional specific, innovative financing techniques that will provide them with a competitive edge in the trade finance market. Convergence provides these advisory services at competitive prices and often subsidized by development institutions.

Client Origination and Funding Support

Through its vast network of physical supply chain partners and own origination team, Convergence sources clients across all industries and commodities to assess trade finance strategies to support corporates through the Abacus network of funding institutions.

Our Client Origination and Funder Allocation process follows a distinct approach to mitigate risk for funders while providing them with attractive opportunities within their investment mandate guidelines:

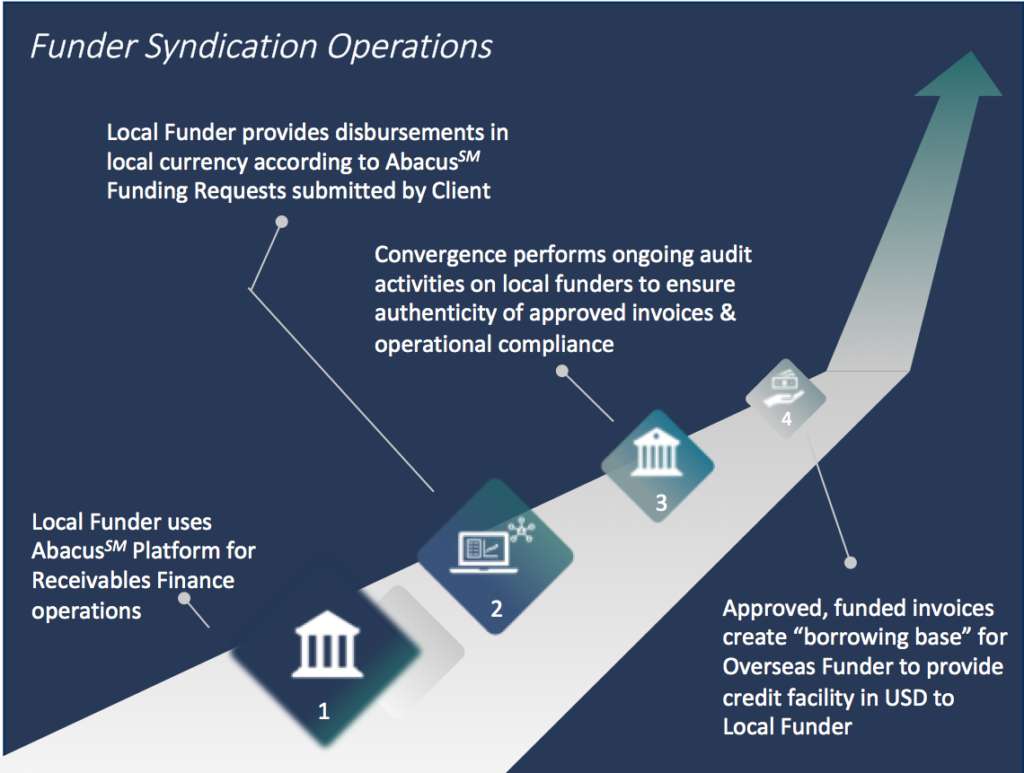

Funder Syndication

Local Funders in emerging markets cannot keep up with the increasing demand for working capital from their clients. Convergence supports these local funders by auditing their ongoing funding operations and using their assigned receivables purchased as a borrowing base to raise capital from overseas lenders to support their local funding activities. While local funding activities are normally provided in local currency, lines of credit from overseas funds are typically provided in USD.

Creating Value

Client Support: At Convergence, we make sure to support sellers, buyers, as well as our funding partners throughout the whole process; from client consultation, onboarding, credit evaluation, funding to maturity settlement. We serve as a gateway of data and communication between corporates and funders.

Partnerships: Convergence represents numerous funding institutions to offer trade finance service throughout the globe. We support overseas hedge funds and banks, primarily in US and Europe, who are looking to allocate investment funds in clients across Asia Pacific and beyond. We also work with local funders in in key emerging markets to support domestic currency transactions. To help mitigate fraud risks, Convergence has also partnered with physical supply chain service providers and associations that provide our platform visibility to data concerning underlying trade transactions.

Transaction Assessment: To ensure successful transactions, Convergence makes sure that we only allocate qualified deals to our funding partners. In reviewing funding requests, there are various facets that needs to be evaluated before approval. Apart from assessing the borrower and obligor’s creditworthiness, Convergence also ensures the legitimacy and viability of trade transactions for funding requests. As Convergence receives funding requests, we reconcile documents according to services level agreements with funders. We ensure the correctness, completeness and validity of document requirements according to sales / service contract.

Technology Platform: Convergence utilizes our web-based online platforms, Unison & Abacus, as a key element of its technology infrastructure.

- Unison is a collaborative data platform that serves as a community that allows Sellers, Buyers, Supply Chain Service Providers and funding institutions to communicate and share data efficiently. It is an online and centralized repository database that allows firms to enroll to the system and upload data. Its main function is to register and onboard companies to bring firms closer to lenders efficiently and effectively.

- Abacus is a streamlined and innovative fund management system that simplifies the process of managing funding requests, funding and maturity settlement processes. The system is designed to help firms minimize the time and effort in requesting funding from lenders locally and internationally, thus reducing operational costs and improving business agility.

Geographical Reach

Convergence has active personnel in Hong Kong, Philippines, Thailand, Singapore and Pakistan. Through their partner network, Convergence has additional, shared resources in Hong Kong, China, Singapore, Indonesia, Thailand, Vietnam, India and Bangladesh. Latin America, Europe, Middle East and Africa are supported through regional representatives.

Existing network has a client base of over 10,000 corporates globally.

Key Offices:

@ Copyright Convergence Trade Solutions PTE LTD. 2022. All Rights Reserved.Web Development Philippines |Privacy Policy