Fintech’s Impact on Due Diligence

Financial Technology, commonly known as Fintech, is an emerging sector in which technology works as main driver in delivering efficient financial services and products. As a new concept in the economic industry, its definition is still complex and may change over time as it develops. “Fintech” is defined as “computer programs and other technology used to support or enable banking and financial services”. However, as more and more companies and financial institutions are slowly engaging on it, fintech now includes innovations such as cryptocurrencies and distributed ledgers.

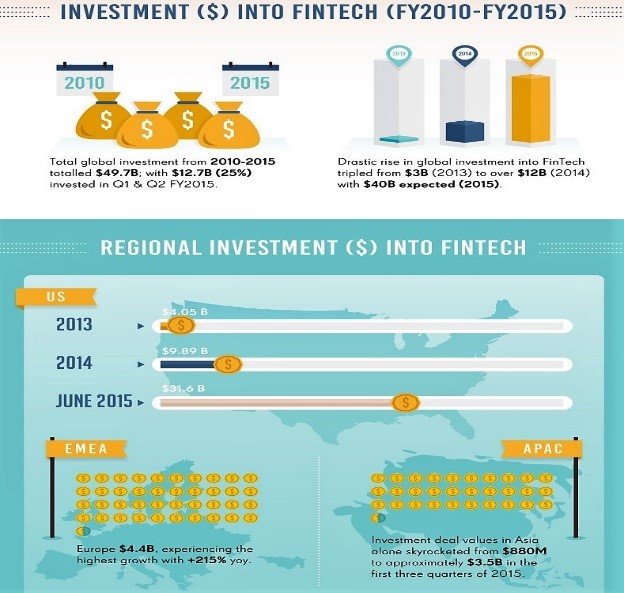

Figure 1: The State of Fintech Industry as We Know It Infographic (Fintech Finance, 2015)

In 2017, USA was marked as the most driven country for Fintech innovation, but it is expected that China will be the leading market for Fintech in 2021. In fact, China is leading the rise of Fintech wave in Asia-Pacific.

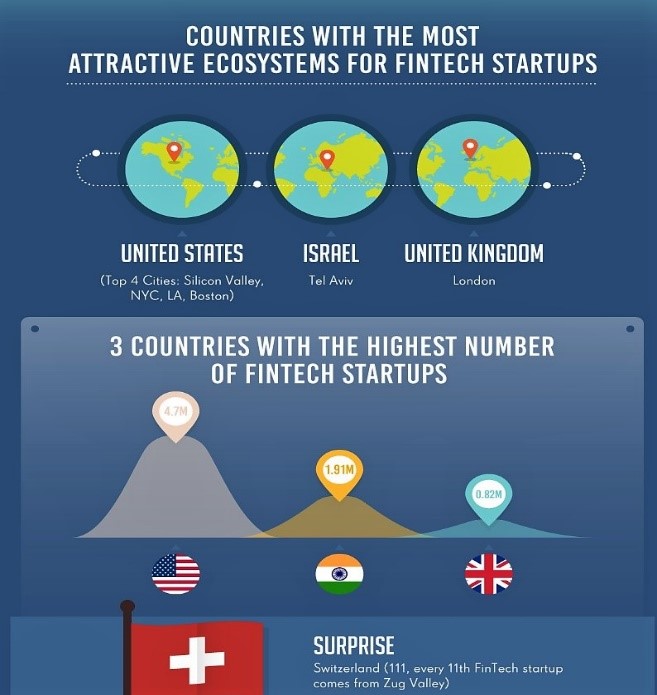

Figure 2: Figure 1: The State of Fintech Industry as We Know It Infographic (Fintech Finance, 2015)

Recently, there have been new standards developing in due diligence that allows banks and investors to verify the background of individuals in the companies they invest in. For companies such as Convergence Capital Group, this is a massive advantage and can provide an ease of mind to funders. With over six thousand suppliers, it is in the best interest of funders to understand their clients.

With new technologies and more powerful machines that can compute billions of calculations every second, the impact on the financial world only grows stronger. An example of technologies on the horizon include predictive behavioural analytics, machine learning / artificial intelligence and data-driven marketing which is already in widespread use today.

In general, platforms are usually operated by trained analysts which harvest digital trails to reveal an individual’s true character, behaviour and networks. It is designed to be used alongside traditional due diligence methods and is also ideal for compliance purposes.

There are, however, some obvious downsides to Fintech and its uses in due diligence and compliance. The use of these newer technologies may require a substantial amount of training, but it will never replace labour altogether. The necessity for analysts to verify and review data cannot be overstated. The blend of science and art will continue to play a part as due diligence evolves to embrace new technologies.

References:

Oxford. (n.d.). fintech | Definition of fintech in English by Oxford Dictionaries. Retrieved from English Oxford Living Dictionaries: https://en.oxforddictionaries.com/definition/fintech

Statitica Report 2017. (2017). Fintech 2017. Statistica .

Previous Post Next Post