International Factoring: Two-Factor System

For the past few years, there has been an increase in international factoring due to the increased international trade of countries and businesses. Companies engaged in international trade are often exposed jurisdictional challenges such as currency, language, and ever changing government trade policies.

Also, there has been a growing demand from the importers that trade should be conducted on open terms. Now, this will mean that the seller will have to wait for weeks or months after delivery for the payment.

Eventually, exporters’ cash flow will be affected especially if payments are delayed further or if importers would not be able to pay the amount due to their own financial issues.

This is where International Factoring can solve this problem among exporters. International Factoring acts as export insurance and early payment. It is offered under an agreement between the ‘factor’ and seller. Under this agreement, the factor buys the seller’s accounts receivable and takes on responsibility for the buyer’s ability to pay. If the buyer cannot pay, the factor will pay the seller.

In relation, there are several types of international factoring, most common of them are the following:

- Single-factoring process

- Two-factor system

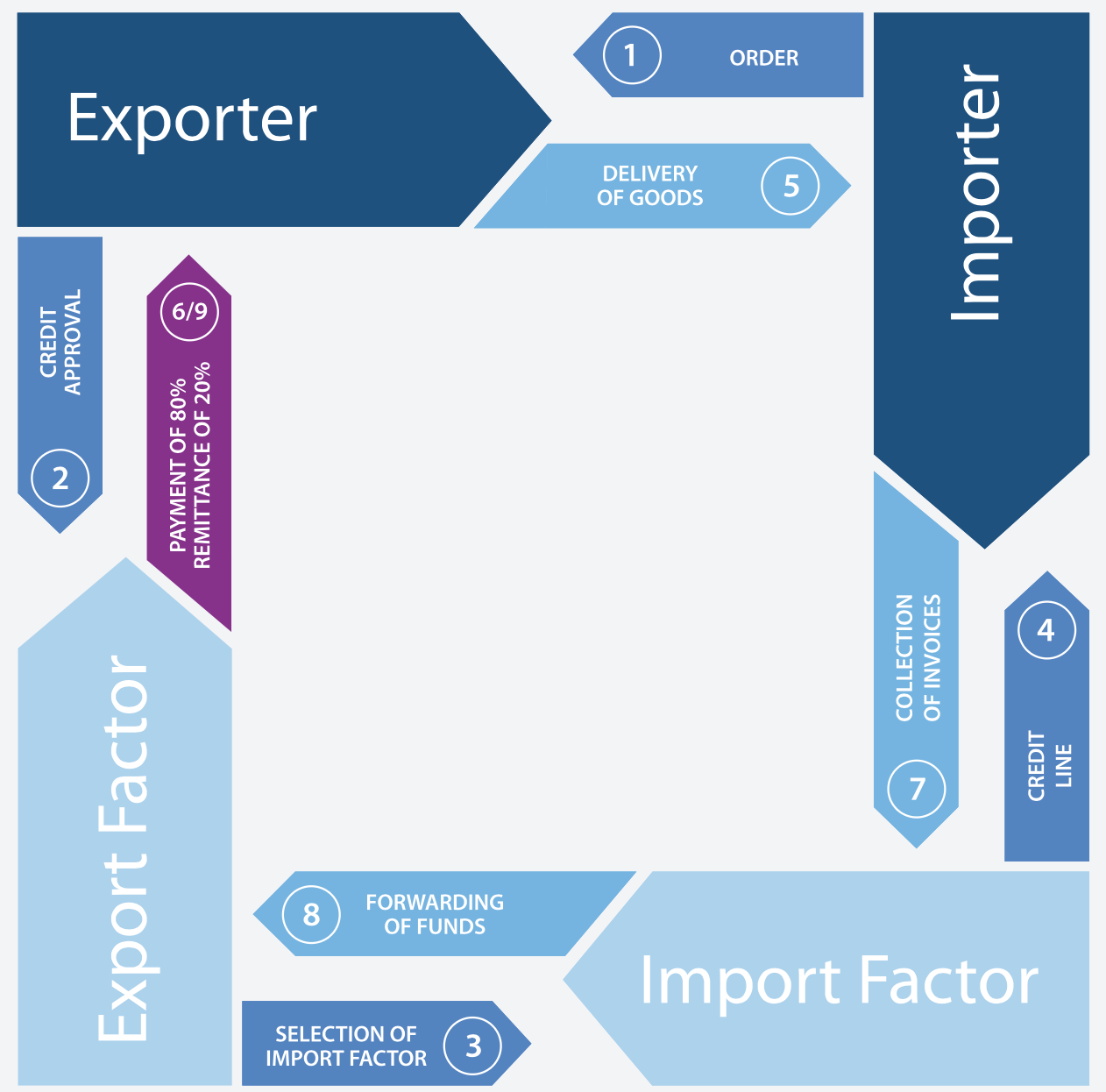

Among these types, the two-factor system, sponsored by a global network such as FCI, is widely used by companies due to its numerous advantages. In this type of factoring system, there are two companies, both from different countries. Its transaction consists of four parties namely: a.) exporter (seller); b.) importer (buyer); 3.) export factor from the exporter’s country; and 4) import factor from the importer’s country.

Below is the Two Factor System process as illustrated by FCI.

Figure 1 Two – Factor System Process; Retrieved from

https://fci.nl/en/solutions/factoring/how-does-it-work, Retrieved on

March 4, 2019

The Two Factor System has proven to be attractive to international trading companies. According to a report 2001- 2015 from FCI, there has been an increase of two-factor volume growth in billions of Euros.

This type of factoring benefits not only the exporter but also the importer. On the exporters side, they will have working capital improvement while also reducing risks and administrative costs. Moreover, by opening flexible credit terms, this will in turn expand their turnover. As for the importers, the two-factor system allows them to expand their purchasing power without using existing credit lines. (FCI, 2019)

The two-factor system continues to allow lenders expand their financing portfolio as well, by working with partner lenders in countries with heir exporters trading counterparts resides. With this ability for lenders to expand their portfolio, reduce risk and maintain compliance with local government policies, we can expect a more growing demand for the two-factor system.

References:

Borad, S. B. (n.d.). International Factoring | Types, Advantages, Process, Pricing, Disputes. Retrieved from eFinance Management: https://efinancemanagement.com/working-capital-financing/international-factoring

FCI. (2019, March 1). About factoring. Retrieved from FCI

FCI. (2019, March 1). Factoring Benefits. Retrieved from FCI : https://fci.nl/en/solutions/factoring/benefits

Previous Post Next Post