The Impact of Digital Banks on Supply Chain Finance and Financial Inclusion

Introduction

In the rapidly evolving financial sector, digital banks have emerged as a beacon of innovation, altering how businesses and individuals interact with their finances. Unlike traditional banking institutions, digital banks leverage cutting-edge technology to offer more accessible, efficient, and cost-effective financial services. This article explores the transformative impact of digital banks on supply chain finance and their role in enhancing financial inclusion, particularly for small to medium enterprises (SMEs) and underserved populations.

Understanding Digital Banks

Definition and Evolution

Digital banks are financial institutions that operate online without traditional physical branch networks. They have grown from fintech innovations aiming to address the inefficiencies of conventional banking, including high fees, slow service, and limited accessibility.

Distinctive Features

Digital banks distinguish themselves through significantly lower operational costs, which arise from their lack of physical branches. This fundamental difference allows them to reduce service fees and offer higher interest rates on savings, making them attractive to cost-conscious consumers. Moreover, their digital nature facilitates faster, technology-driven onboarding processes that can reach customers in remote or underserved areas, previously inaccessible to traditional banks.

Financial Inclusion and Digital Banks

Expanding Reach

By harnessing technology, digital banks extend their services to a broader audience, including SMEs and individuals in remote locations. Their flexible and innovative financial products are particularly suited to customers who may not meet the stringent requirements of traditional banks.

Asset-Backed Financing

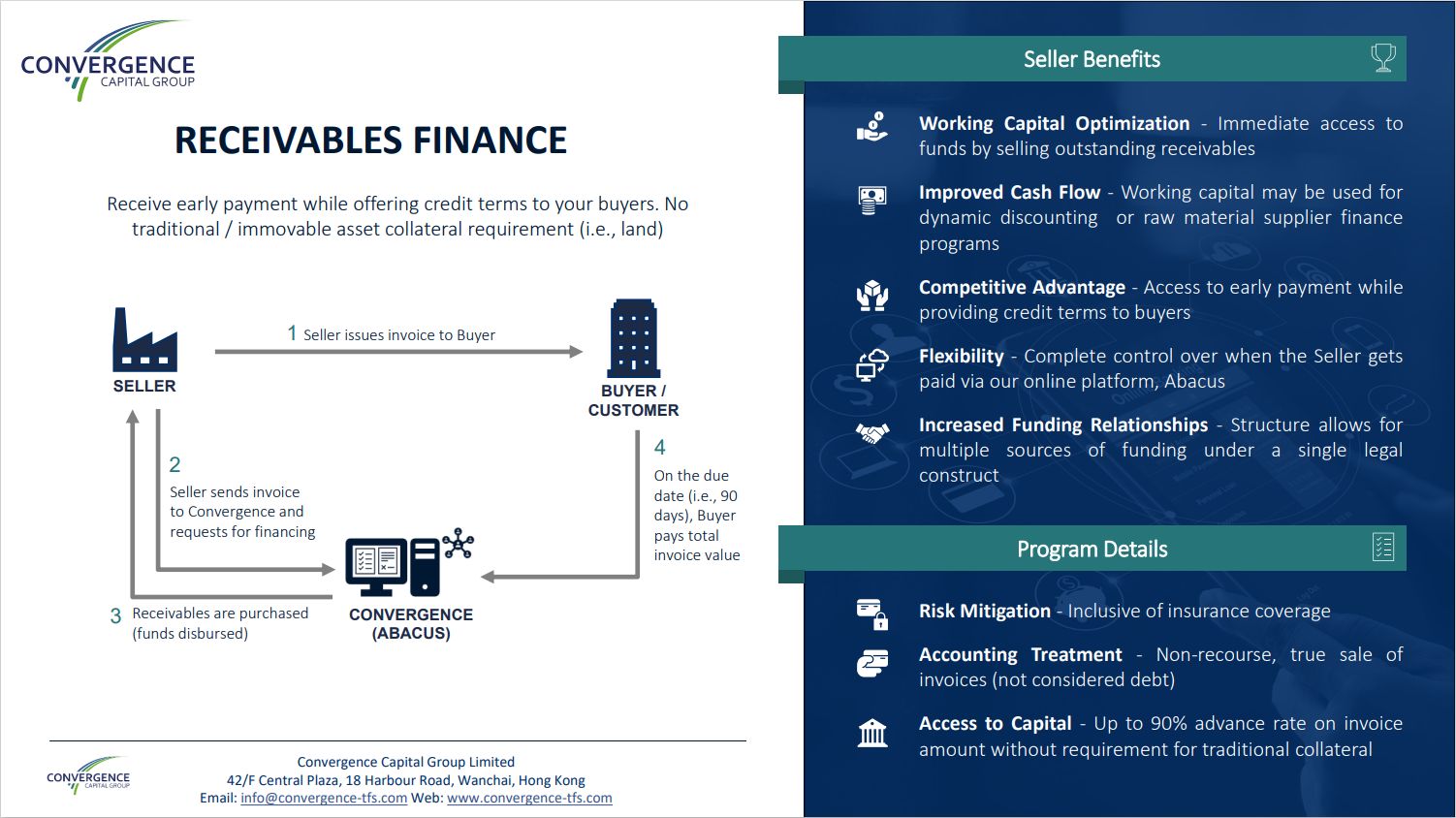

A key aspect of financial inclusion involves providing SMEs with viable financing options. Digital banks are pioneering in offering loans backed by movable assets rather than immovable assets. Movable assets, such as machinery, inventory, and receivables, offer a dynamic collateral that doesn’t tie a business down to one location—unlike immovable assets like land or buildings. This flexibility is crucial for SMEs that need liquidity but may not own property.

Digital Banks and Supply Chain Finance

Technology Integration

Digital banks excel in integrating technology to streamline and enhance supply chain finance—a critical area for businesses that manage extensive inventories or operate on thin margins. Key technological advancements include:

- Procure-to-Pay Processes: Digital banks simplify these processes through automated systems that enhance transaction speed and accuracy, reducing the operational burden on businesses.

- Payments Automation: Automating payments can significantly reduce errors and improve cash flow management. Digital banks offer platforms that synchronize payment processes with the supply chain cycle, ensuring timely transactions.

- Data Collection and Analysis: Advanced analytics and data collection tools offered by digital banks enable businesses to gain deeper insights into their supply chain operations, helping them make informed decisions to optimize efficiency and reduce costs.

Case Studies and Examples

An example of a digital bank making significant strides in this area is Revolut, which has developed financial solutions specifically tailored for SMEs, such as easy integration with accounting software and instant invoice financing options. These services not only improve the efficiency of supply chain operations but also ensure that businesses have quick access to needed capital.

Concluding Remarks

Digital banks are not merely an alternative to traditional banking; they are a revolutionary force reshaping the financial landscape. By focusing on technology and customer-centric solutions, they offer a pathway to financial inclusion for SMEs and contribute robustly to the optimization of supply chain finance. As technology evolves, so too will the capabilities of digital banks, potentially leading to even greater innovations and wider reach.

Further Reading and Resources

For those interested in exploring this topic further, resources such as the book “Bank 4.0” by Brett King and the Fintech Futures website provide extensive insights into the future of digital banking.

Call to Action

As digital banking continues to grow, staying informed and engaging with these new financial technologies can provide significant benefits. Consider exploring digital banking solutions, participating in fintech forums, or sharing this article with peers to spread the word about the exciting developments in this field.

This comprehensive exploration of digital banks illustrates their pivotal role in modern finance, promising a more inclusive and efficient future for all market participants.

Please do not hesitate to Contact Us if in need of a financing solution for your company or if you are in need of a technology and asset servicing solution if you are a funder.

Previous Post Next Post